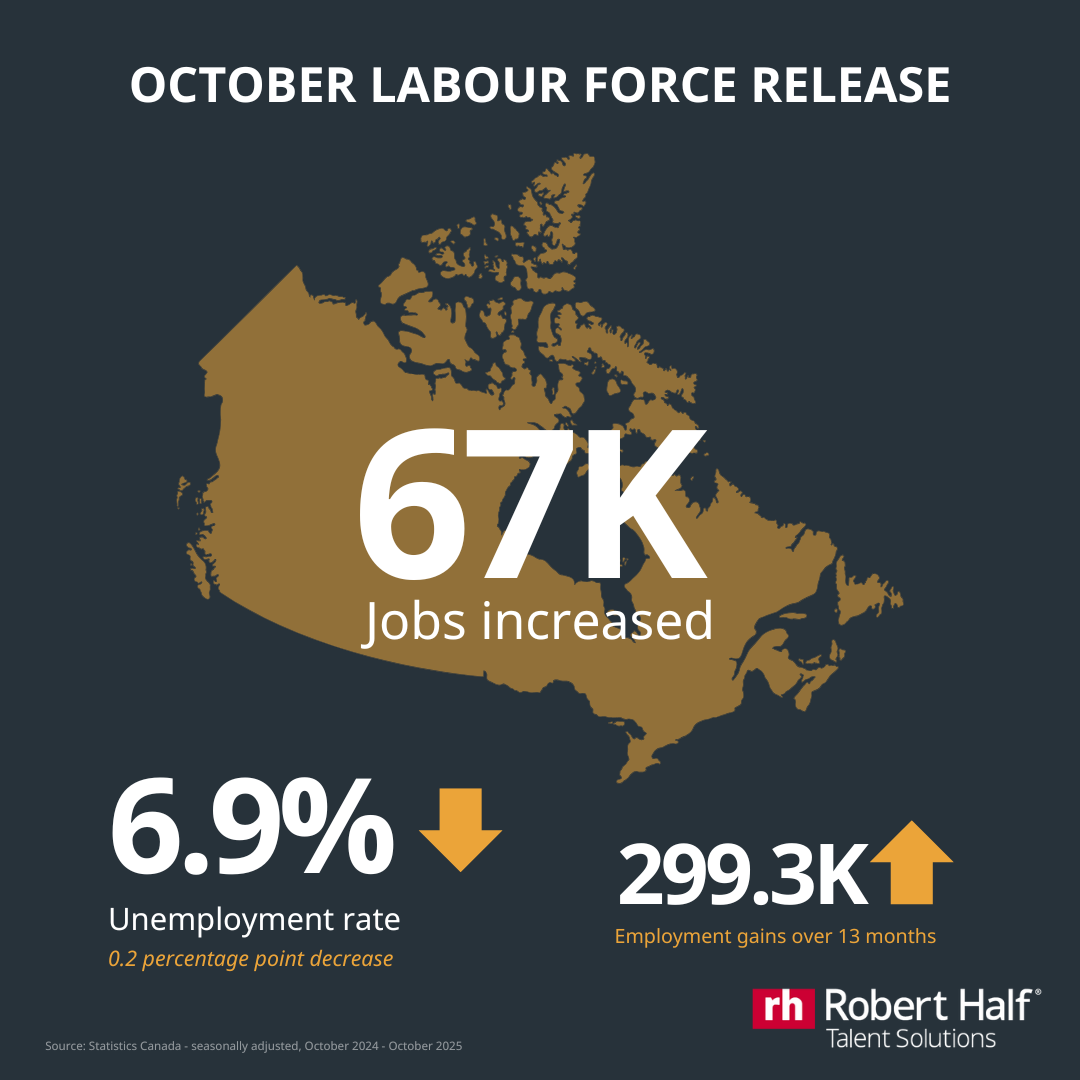

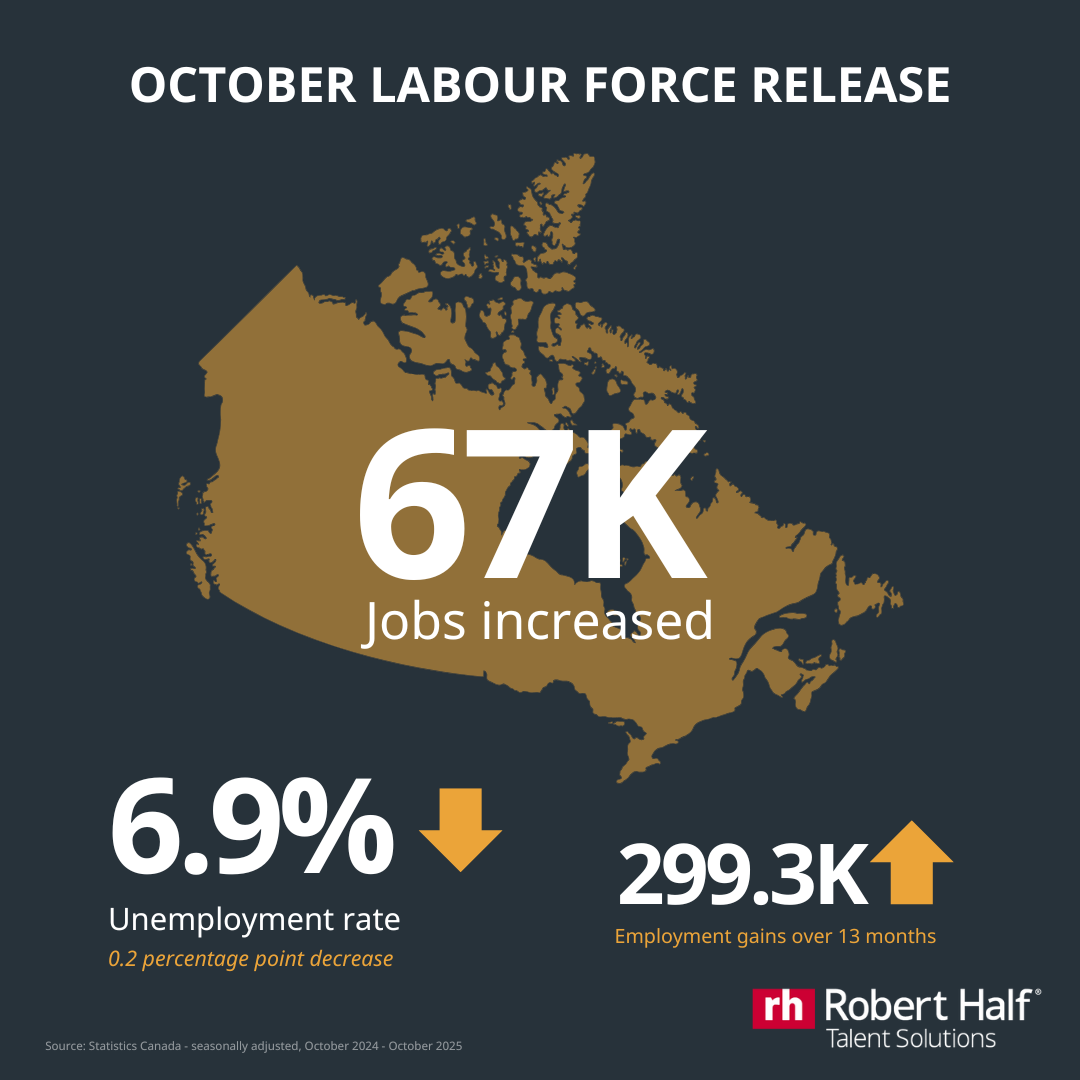

Job gains and losses in October 2025

Employment trends across industries in October 2025 showed a slight reversal of previous month’s gains and losses. The largest gains were concentrated in the following sectors:

Wholesale and retail trade saw a significant rebound, increasing by 41,000 jobs (+1.4 per cent from September), more than offsetting the decline it saw in September of -21,000 jobs. YoY the industry is up by +108,000 jobs (+3.7%).

Transportation and warehousing added 30,000 jobs (+2.8 per cent from September).

Information, culture and recreation also posted a gain, rising by 25,000 (+3.0 per cent from September).

Other industries that reported job gains in October 2025, according to Statistics Canada, include:

Manufacturing: +8,700 (+0.5 per cent)

Utilities: +7,600 (+4.6 per cent)

Public administration: +7,100 (+0.6 per cent)

Percentages above represent MoM change

On the other hand, industry declines were recorded in Construction, which shed 15,000 jobs (-0.9 per cent from September). Employment in this industry was virtually unchanged from a year earlier. From January to October 2025, employment in goods-producing industries recorded a net decline of -54,000 jobs (-1.3%), largely reflecting decreases in Construction and Manufacturing. In comparison, employment in services-producing industries increased by +142,000 jobs (+0.8%) over that period.

Other industries that reported job losses in October 2025, according to Statistics Canada, include:

Other services*: -8,200 (-1 per cent)

Health care and social assistance: -7,200 (-0.3 per cent)

Educational services: -7,000 (-0.4 per cent)

Business, building and other support services: -6,800 (-1.0 per cent)

Finance, insurance, real estate, rental and leasing: -3,800 (-0.3 per cent)

*‘Other services’ includes businesses and organizations providing services not covered by other sectors.