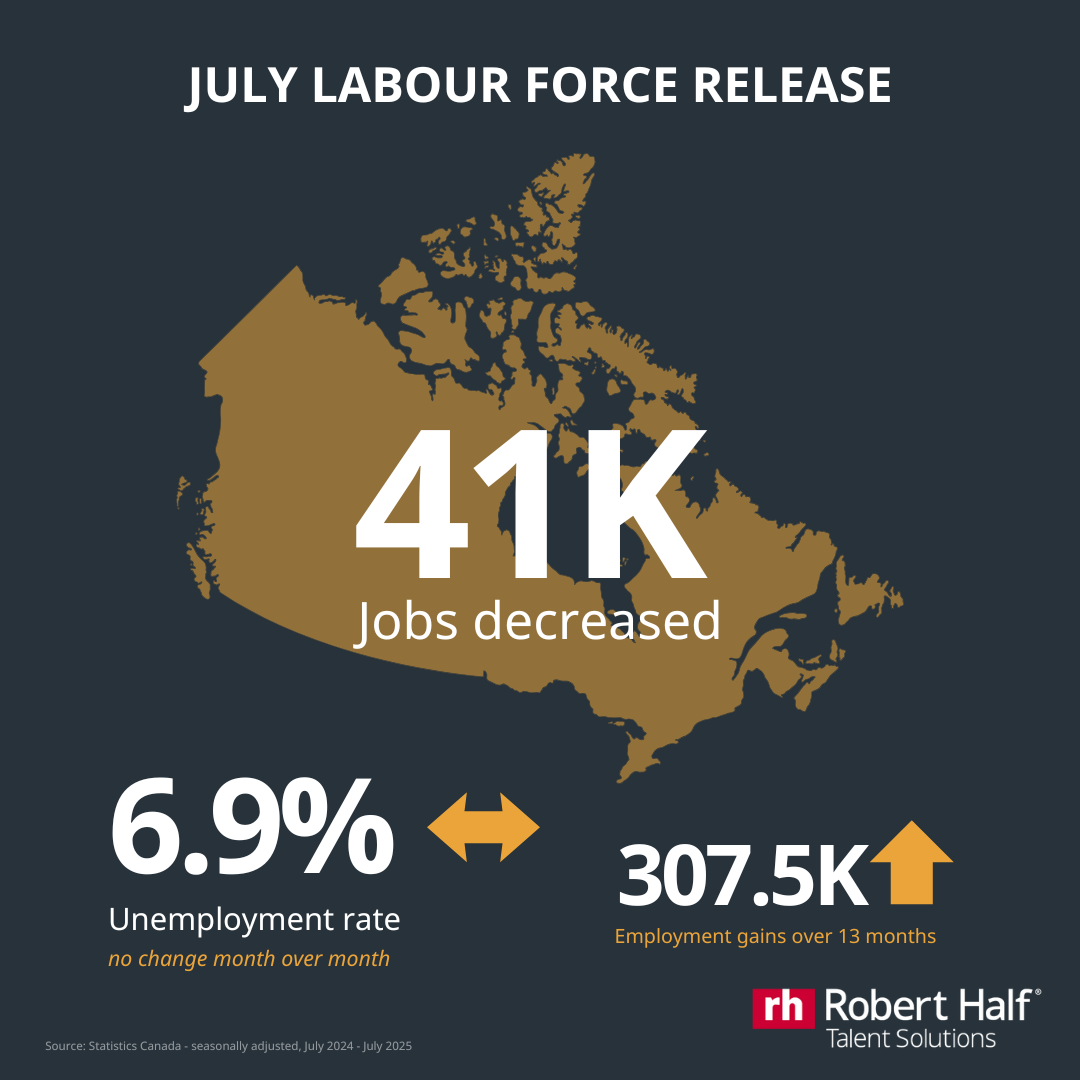

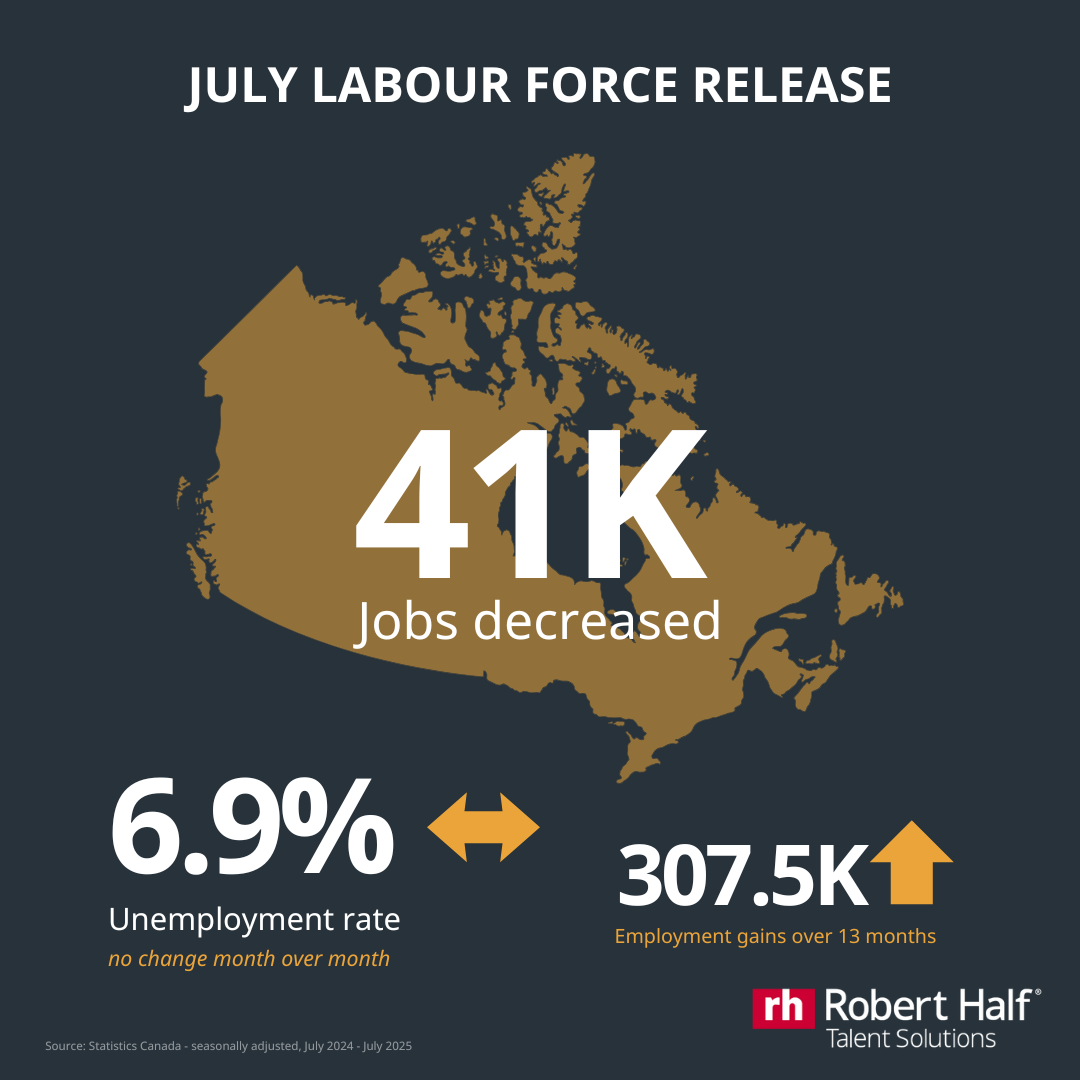

Job Gains and Losses in July 2025

Employment trends across Canadian industries were mixed in July 2025, with notable declines in several key sectors. The information, culture and recreation industry saw the largest drop, shedding roughly 29,000 jobs (-3.5 per cent from June) after gains earlier in the spring. Construction also experienced a setback, losing 22,000 jobs (-1.3 per cent from June) following months of stability. Business, building and other support services fell by 19,000 jobs (-2.8 per cent from June), continuing a downward trend observed over recent months. Health care and social assistance declined by 17,000 jobs (-0.6 per cent from June), reversing gains made in in the month prior – though employment in this sector remains up 1.9 per cent year-over-year.

Other industries that reported job losses in July 2025, according to Statistics Canada, include:

Agriculture: -10,800 jobs lost (-4.8 per cent)

Finance, insurance, real estate, rental and leasing: -6,000 jobs lost (-0.4 per cent)

Public administration: -3,300 jobs lost (-0.3 per cent)

Natural resources: -1,400 jobs lost (-0.4 per cent)

Wholesale and retail trade: -2,500 jobs lost (-0.1 per cent)

Utilities: -500 jobs lost (-0.3 per cent)

*Percentages above represent MoM change

While overall employment remained flat in July 2025, a few sectors posted modest gains. Transportation and warehousing led the way with an increase of 26,000 jobs (+2.4 per cent from June), bringing employment in the sector slightly above its January 2025 level for the first time this year. Educational services also saw growth, adding 22,000 jobs (+1.4 per cent from June), which helped offset losses in other areas. Manufacturing also saw a modest increase of +5,300 jobs (+0.3 per cent from June). These gains, though limited, highlight pockets of resilience in an otherwise cooling labour market.