A career in accounting can take you any number of places, depending on the path you choose.

If you’re someone who is already working in the finance and accounting space, you would know management accounting and financial accounting are just two of the options open to you, and each role occupies a unique place in the business finance function.

If you’re a recent university graduate or are considering changing the direction of your finance career and you’ve been deliberating between the two roles, then fear not.

Our finance and accounting recruitment experts are here to share details on the difference between financial accounting and management accounting. You will walk away understanding what each role involves, where they intersect, and how to identify which path aligns best with your skills, values, and career goals.

Let’s explore the possibilities so you can move forward with clarity and confidence.

Related: What accounting careers have to offer

What is a Financial Accountant?

Financial Accountants are responsible for creating industry-standard reporting on behalf of the company they work for. They’re tasked with recording and reporting all finances so regulators, investors, and creditors can accurately assess business performance and solvency.

As a Financial Accountant, you'd be responsible for ensuring business income statements align with strict reporting standards. You’ll also act as the main point of contact for tax, superannuation, auditing, and other financial issues.

“Understanding the differences between accounting and management accounting is essential for anyone deciding on their career path,” says Will Cannaby, Regional Director at Robert Half and specialised finance and accounting recruiter. “Financial accounting focuses on retrospective reporting and compliance, whereas management accounting is about interpreting data and forming strategies to shape future business decisions.”

Financial Accountant duties

Act as the key contact for tax compliance, superannuation reporting, audit processes, insurance, and statutory obligations

Prepare monthly and quarterly financial reports for internal and external stakeholders

Manage year-end reporting, including preparation of financial statements and audit schedules

Ensure all accounts comply with AASB standards and internal/external audit requirements

Prepare and lodge Business Activity Statements (BAS), including GST reporting

Perform balance sheet reconciliations and ensure account accuracy

Support and conduct internal audit activities and financial control reviews

Financial Accountant skills and qualifications

Search Financial Accountant roles

CA or CPA qualification

Experience with Australian statutory reporting and AASB standards

Strong technical accounting and financial reporting skills

An analytical mind

Negotiation skills and the ability to develop strong working relationships

Commercial and business awareness

Good written and verbal communications skills

A keen eye for detail and desire to probe further into data

Deadline-orientated and an ability to stick to time constraints

What is a Management Accountant?

A Management Accountant helps managers within the business make well-informed decisions by providing highly detailed reporting. Their tailored reports are created for internal use and are designed to help identify investment opportunities, plan budgets, and manage risk.

Management Accountants can work for government organisations and both private and public companies. They assist the Board of Directors and the CEO in making strategic decisions and can also be called on for business partnering duties.

“A career in management accounting typically evolves through progressive, hands-on roles within a company’s finance team,” says Will Cannaby.

“Rather than following a single set pathway, many professionals start in transactional finance roles and grow into more strategic positions as they gain exposure and complete qualifications like ACCA, CA or CPA. What’s exciting is the flexibility. In my 15 years of experience, I’ve seen some people move into commercial business partnering, while others chart a course toward leadership in finance.

"Most companies may look for a degree at the entry point, but it’s not always essential. What matters most is your ability to build practical experience and apply it while you work toward your professional qualifications. Typically, it takes around three to four years to become fully qualified, and from there, opportunities open up in both technical finance and more commercially focused roles.”

Management Accountant duties

Financial analysis

Business performance reporting

Preparing monthly accounts

Payroll cost analysis and collaboration with payroll teams

Cash flow management and forecasting

Preparing forecasts and budgets

Support the response to requests from senior management and other stakeholders as necessary

Management Accountant skills and qualifications

Search Management Accounting roles

CPA or CA qualification

Knowledge of GST, superannuation obligations, and AASB/IFRS standards

Strong analytical and commercial thinking skills

Strong attention to detail

Organisation skills

Problem-solving skills

Communication skills

How do both functions examine data?

Financial accounting and management accounting, while both crucial parts of a business's financial health, differ significantly in their approach to data.

Financial accounting acts as the company's memory, meticulously recording past financial transactions. This data forms the basis of financial statements – the income statement, balance sheet, and cash flow statement – which paint a picture of a company's financial performance over a specific period, typically a quarter or a year.

Financial Accountants adhere to a set of standardised rules, like the Australian Accounting Standards Board (AASB) in Australia, the Generally Accepted Accounting Principles (GAAP) in the US, or the International Financial Reporting Standards (IFRS) globally. These standards ensure consistency and comparability, allowing external users like investors, creditors, and regulators to assess the company's financial health immediately.

“Unlike financial accounting, which focuses on historical performance, management accounting takes a forward-looking approach,” says Will Cannaby.

“It draws on forecasts and estimates to support planning and decision-making. With access to a broader data set, Management Accountants can produce tailored reports that help businesses analyse cost behaviour, evaluate the profitability of different product lines, and measure the impact of marketing strategies.”

How do both functions engage in reporting?

In relation to reporting, a key difference between accounting and management accounting is the financial reports generated to serve different purposes and audiences.

Financial accounting provides a standardised set of statements for external users, while management accounting creates a wider variety of reports specifically designed to meet the needs of internal decision-makers.

Financial accounting culminates in three core financial statements:

Income statement - This statement summarises a company's revenue and expenses over a specific period, ultimately revealing the net income or loss. It provides a clear picture of the company's profitability.

Balance sheet - This statement offers a snapshot of the company's financial position at a specific point in time. It shows what the company owns (assets), owes (liabilities), and the difference, which represents shareholder equity.

Cash flow statement - This statement details the cash inflows and outflows of the company over a period, categorised into operating, investing, and financing activities.

These standardised statements are crucial for external users like investors and creditors to assess a company's financial health, performance, and risk. The consistent format allows for easy comparison between Australian and global companies within the same industry.

Management accounting reports are not limited to a standardised format. Instead, they are customised to address specific managerial concerns and decision-making needs. Some key examples of management accounting reports include:

Cost-Volume-Profit (CVP) analysis - This report helps managers understand the relationship between costs, sales volume, and profit. It allows them to forecast the impact of changes in sales volume or pricing on profitability.

Budgeting - Budgets are detailed financial plans outlining future income and expenses. They help managers set goals, allocate resources effectively, and track progress towards those goals.

Variance analysis - This report compares actual results with budgeted figures, identifying any significant deviations. Variance analysis helps managers pinpoint areas where costs might be exceeding expectations or revenue might be falling short, allowing for corrective action.

These are just a few examples, and the specific reports generated by management accounting will vary depending on the nature and size of the business.

The key takeaway is that management accounting reports provide a deeper dive into the company's financial performance, offering insights that go beyond the basic information presented in financial statements.

This tailored information empowers managers to make informed decisions that can improve operational efficiency, profitability, and overall business performance.

What is the regulatory difference between both functions?

Another difference between accounting and management accounting is the regulations for both functions.

The financial information a company presents holds significant weight, impacting investment decisions, lending opportunities, and public perception. To ensure the accuracy and reliability of this information, financial accounting operates within a stricter regulatory framework compared to management accounting.

Financial statements prepared by a company undergo external audits by independent accounting firms. These audits are crucial for maintaining public trust in the financial reporting process. Auditors meticulously examine the company's financial records and accounting practices to ensure compliance with accounting standards set by the Australian Accounting Standards Board (AASB), which are aligned with International Financial Reporting Standards (IFRS).

Any discrepancies or deviations from these standards must be disclosed and explained in the financial statements. This external scrutiny serves as a safeguard against fraudulent reporting or manipulation of financial data.

The difference with management accounting reports is that they are not subject to the same level of external oversight. Since they are intended for internal use by managers, there is no requirement for independent audits.

“That doesn’t mean management accounting operates in a free-for-all environment,” adds Will Cannaby. “Strong internal controls are still essential to ensure the data used in these reports is accurate, consistent, and reliable.”

What is the difference between career paths?

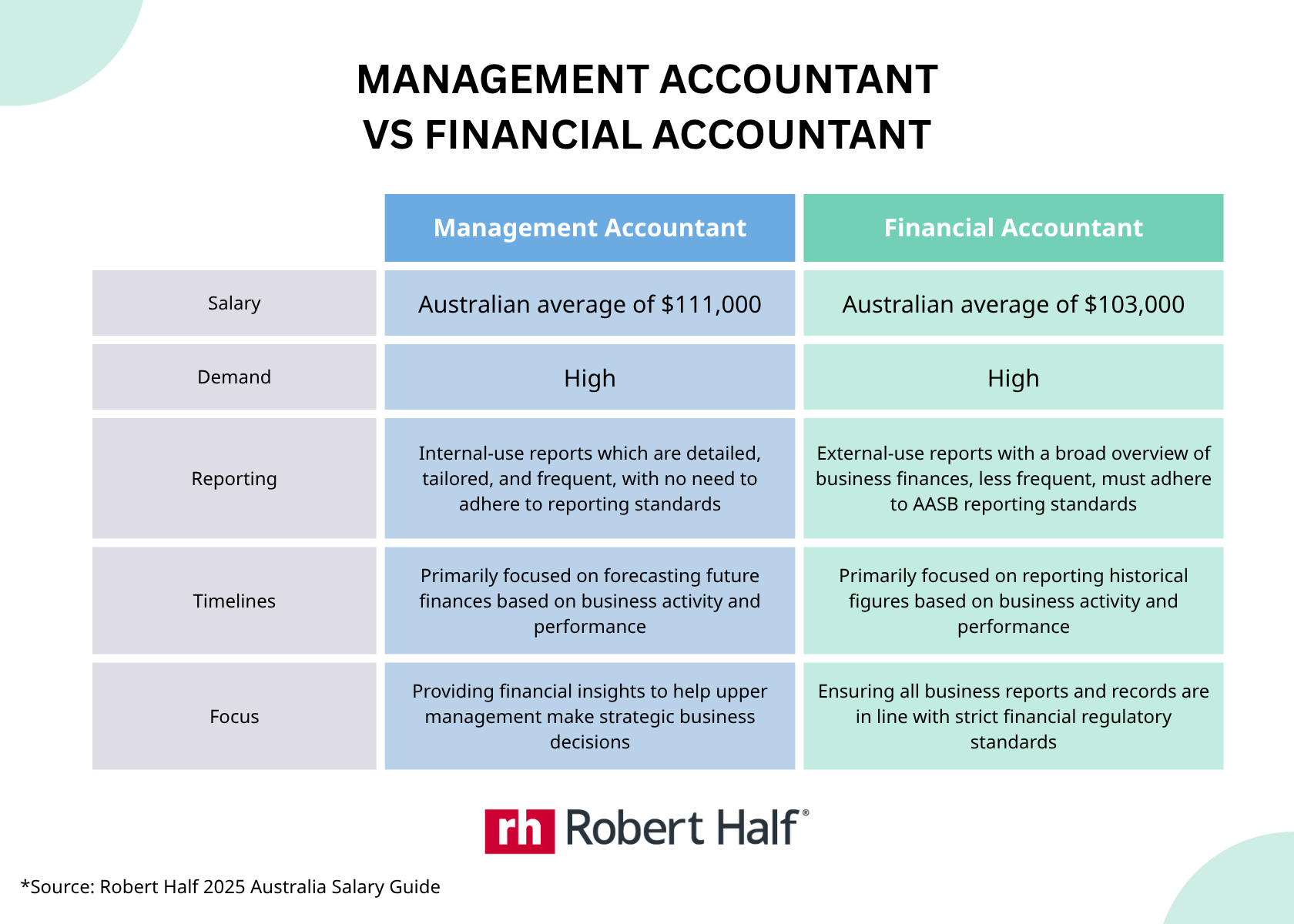

According to data collected by the 2025 Robert Half Australia Salary Guide, both Financial Accountants and Management Accountants sit within the top in-demand roles for finance and accounting in Australia.

You’ll see that in some ways, the entry ‘assistance’ level can start the same for both, but the biggest difference between financial accounting and management accounting is where the roles take you.

Related: How to negotiate an accounting salary

Career paths in financial accounting

1. Entry-Level Roles (0-3 years experience)

Graduate Accountant - Often the first step after university, usually involves rotations or foundational tasks in financial reporting, reconciliations, and general ledger management. Many roles offer CA/CPA study support. (no link for this one as it is not in our Salary Guide)

Assistant Accountant - Supports a Financial Accountant or Financial Controller, handling daily transactions, reconciliations (bank, balance sheet), preparing journals, assisting with month-end close, and some reporting.

Accounts Officer / Accounts Payable / Accounts Receivable: More specialised transactional roles focusing on managing invoices, payments to suppliers, or collecting payments from customers. These can be entry points but often lead into broader accounting roles.

2. Mid-Level Roles (3-7 years experience)

Chartered Accountant (CA ANZ or CPA Australia) - These prestigious qualifications open doors to a wide range of positions in audit firms, financial services, and corporate finance. Expect a focus on tasks like preparing financial statements, conducting audits, and ensuring regulatory compliance.

Tax Accountant - Specialising in tax laws and regulations, tax accountants advise businesses on minimising tax liabilities. They can work in public accounting firms, corporations, or government agencies.

Financial Accountant - This is a core role. Responsible for preparing monthly, quarterly, and annual financial statements (Profit & Loss, Balance Sheet, Cash Flow), managing the general ledger, ensuring compliance with AASB/IFRS, assisting with budgeting and forecasting, and liaison with auditors. This role exists in virtually all medium to large organisations.

Senior Financial Accountant - Takes on more complex financial reporting issues, may supervise junior staff, handle group consolidation (for larger entities), manage specific accounting areas (e.g., fixed assets, intercompany), and play a bigger role in year-end statutory accounts. Often requires CA or CPA qualification.

Project Accountant - Focuses on the financial aspects of specific projects, tracking costs, revenue recognition, and reporting against project budgets. Common in construction, tech, or large-scale infrastructure companies.

3. Senior & Management Roles (7+ years experience)

Financial Controller - A leadership role, typically overseeing the entire financial accounting function. Responsible for the accuracy and integrity of financial reports, internal controls, statutory compliance, tax obligations, and managing the accounting team. Often reports directly to the CFO.

Group Accountant/Group Financial Accountant - In larger, multi-entity organisations, this role focuses on consolidating financial statements from various subsidiaries, ensuring consistent reporting across the group, and managing complex intercompany transactions.

Financial Accounting Manager - Manages a team of Financial Accountants, setting workflows, reviewing output, and ensuring timely and accurate financial reporting.

4. Executive & Strategic Roles (10+ years experience)

Chief Financial Officer (CFO) - The pinnacle of a financial accounting career. The CFO is a key member of the executive team, responsible for the overall financial strategy, financial planning and analysis (FP&A), risk management, capital allocation, and leading the entire finance function.

Finance Director / Head of Finance - Similar to a CFO, particularly in smaller to medium-sized enterprises (SMEs) or specific divisions of larger corporations.

Partner (Public Practice) - For those who excel in accounting firms, becoming a partner involves owning a share of the business, leading a practice area (e.g., audit, tax, advisory), and driving significant revenue.

Related: 10 financial skills to include in your CV

Career paths in management accounting:

Entry-Level Roles (0-3 years experience):

Assistant Accountant - Supporting senior accountants with data entry, report generation, variance analysis, and basic budgeting tasks.

Business Analyst (entry-level) - Often a stepping stone, focusing on specific business problems, financial modelling, and data interpretation to support decision-making.

Mid-Level Roles (3-7 years experience):

Management Accountant - This is the core role, involving the preparation of management reports, detailed budget analysis, cost control, performance measurement, and contributing to strategic initiatives.

Commercial Analyst - Focuses more on providing commercial insights, pricing analysis, and supporting sales or operations teams with financial data to drive business growth.

Financial Analyst - Often works closely with Management Accountants, but may have a stronger emphasis on investment appraisal, forecasting, and detailed financial modelling for specific projects or departments.

Cost Accountant - Specialises in tracking, analysing, and reporting on the costs of production or services, crucial in manufacturing, retail, or service industries.

Chartered Management Accountant (CA ANZ or CPA Australia) -This recognised qualification opens doors to roles like financial analyst, cost accountant, and business partner. Expect to be involved in budgeting, forecasting, cost analysis, and providing insights to improve operational efficiency and profitability.

Senior-Level Roles (7+ years experience):

Senior Management Accountant - Leading a team of junior accountants, overseeing complex reporting, and playing a more significant role in strategic planning and financial modelling.

Finance Manager - Overseeing a finance team, managing budgeting processes, financial reporting (both management and sometimes statutory), and acting as a key business partner to non-finance departments.

Financial Controller - Often responsible for the overall financial health of an organisation, ensuring robust financial controls, accurate reporting, and providing strategic financial advice. This role often encompasses both financial and management accounting functions.

Commercial Finance Manager/Business Partner - A highly strategic role, embedded within a business unit or division, providing direct financial insights and challenge to operational leaders, helping them drive profitability and efficiency.

Even though they lead down different career paths, having a solid understanding of the difference between financial accounting and management accounting is a real asset to help you make an educated decision on which direction is best for you.

Understanding how financial statements are prepared provides context for management accounting analysis. Conversely, management accounting skills can enhance your ability to communicate financial information effectively in financial accounting roles.

Will Cannaby offers this final piece of advice: "Whichever path you choose, building a blend of both skill sets can open doors, deepen your confidence, and make you a more well-rounded finance professional."

Frequently asked questions (FAQs)

What is the difference between management and financial accounting?

While both management and financial accounting fall under the broader accounting discipline, they serve very different purposes.

Financial accounting focuses on recording historical financial transactions and producing standardised reports, such as income statements, balance sheets, and cash flow statements, in line with Australian regulatory frameworks like AASB standards. These reports are primarily used by external stakeholders to assess a company’s financial health.

Management accounting, on the other hand, is forward-looking. It provides internal stakeholders with tailored financial insights to support decision-making, budgeting, forecasting, and business planning. Management Accountants analyse operational and financial data to help business leaders set strategy and improve performance.

How do Australian businesses leverage both financial and management accounting for success?

Successful Australian businesses understand that both financial and management accounting play complementary roles.

Financial accounting ensures companies meet their statutory obligations, maintain investor confidence, and uphold financial integrity. It’s particularly critical for publicly listed companies that must comply with AASB standards and undergo regular audits.

Management accounting enables proactive, data-driven decisions. Australian businesses use it to create forecasts, optimise budgets, assess the impact of business strategies, and manage risk.

Together, these functions help businesses maintain compliance while also staying competitive, agile, and growth-focused.

What type of accountant has the highest salary?

In 2025, Management Accountants commanded a slightly higher average salary than their Financial Accountant counterparts, with a difference of approximately $8,000 at the mid-career level. While both roles are similarly valued in the Australian market, Senior Management Accountants reported the highest average annual earnings, just $5,000 above those in senior financial accounting roles.

The relatively small gap reflects the increasing demand and importance of both skill sets across industries.

What are some of the differences between accounting software used between both functions?

The distinction between financial accounting and management accounting extends to the software packages used.

Financial accounting typically uses platforms like Xero, MYOB, QuickBooks Online, or Sage, depending on the size and complexity of the business.

Management Accountants may use platforms like Anaplan, Planful, Workday Adaptive Planning, or business intelligence tools like Power BI or Tableau to support internal planning, budgeting, and analysis.