Connect with Will

As a Regional Director at Robert Half, Will Cannaby, the author of this blog, has forged a reputation for driving business growth and talent strategy based on his 15-years-plus experience as a specialist recruiter in accounting and finance. Will has a focus on senior leadership roles, though his expertise spans CFO appointments and their direct reports, while also recruiting for niche corporate Head Office roles covering tax, internal audit, and treasury.

Many ASX/NYSE-listed companies, international businesses and SMEs have relied on Will’s ability to source talent with the ability to deliver high-impact solutions. And over the past five years, he has helped to advance the careers of over 2,500 candidates and supported more than 500 clients in securing top-tier talent. This track record reflects his passion for connecting businesses with professionals who can drive performance and growth.

In short

The question: What is management accounting and how does someone know it is the right finance role for them?

The answer: If someone wants to focus on internal finances for a business that is future-focused, helps aid decision-making, builds on existing skills in an in-demand field, management accounting could be the job for them.

The result: Professionals who are interested in turning numbers into strategy will find this role be rewarding. Even if management accounting is not what someone does for the rest of their career, management accounting can provide a strong foundation for many career paths in finance and accounting.

According to the 2025 Robert Half Salary Guide, accounting is one of the top functional areas of finance with the highest levels of permanent recruitment.

For goal-oriented jobseekers on the hunt for security and professional growth, management accounting could be a career path worth exploring.

As a recruitment specialist in the finance and accounting sector, it’s an area that I’m often quick to recommend, not only for its versatility, but for its capacity to provide a strong foundation for many finance and accounting career paths.

With more than 15 years of accounting and finance recruitment experience, I’m uniquely poised to observe workplace operations in this space.

In my role at Robert Half, I lead the talent strategy across Sydney’s Finance, Accounting, Financial Services, Legal, Risk, Compliance, Technology, and Human Resources markets. My expertise spans CFO appointments and their direct reports, including Financial Controllers, Finance Managers, Management Accountants, and FP&A professionals.

I’ve seen firsthand how a management accounting career path goes beyond just balancing the books. It’s about strategy, foresight, and optimising business performance. I’ve placed many management accountants over the years, and I truly believe it’s a role that could set you on an upward trajectory in the industry.

If you’ve ever wondered, ‘What is management accounting?’ this blog is for you.

Join me as I explore management accounting from what it is and how it fits into a broad range of finance careers, from budgeting and forecasting roles to strategic decision-making support.

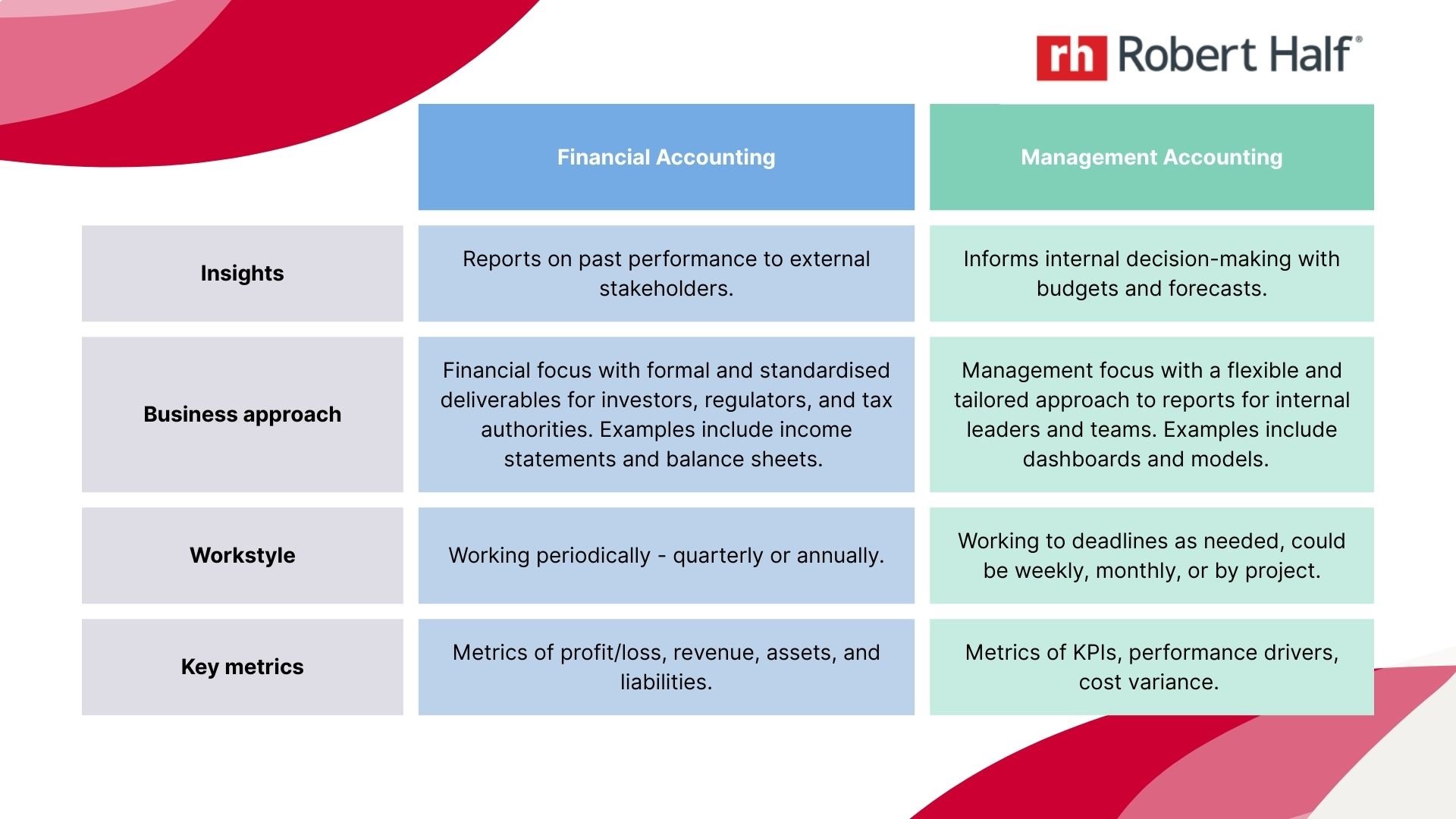

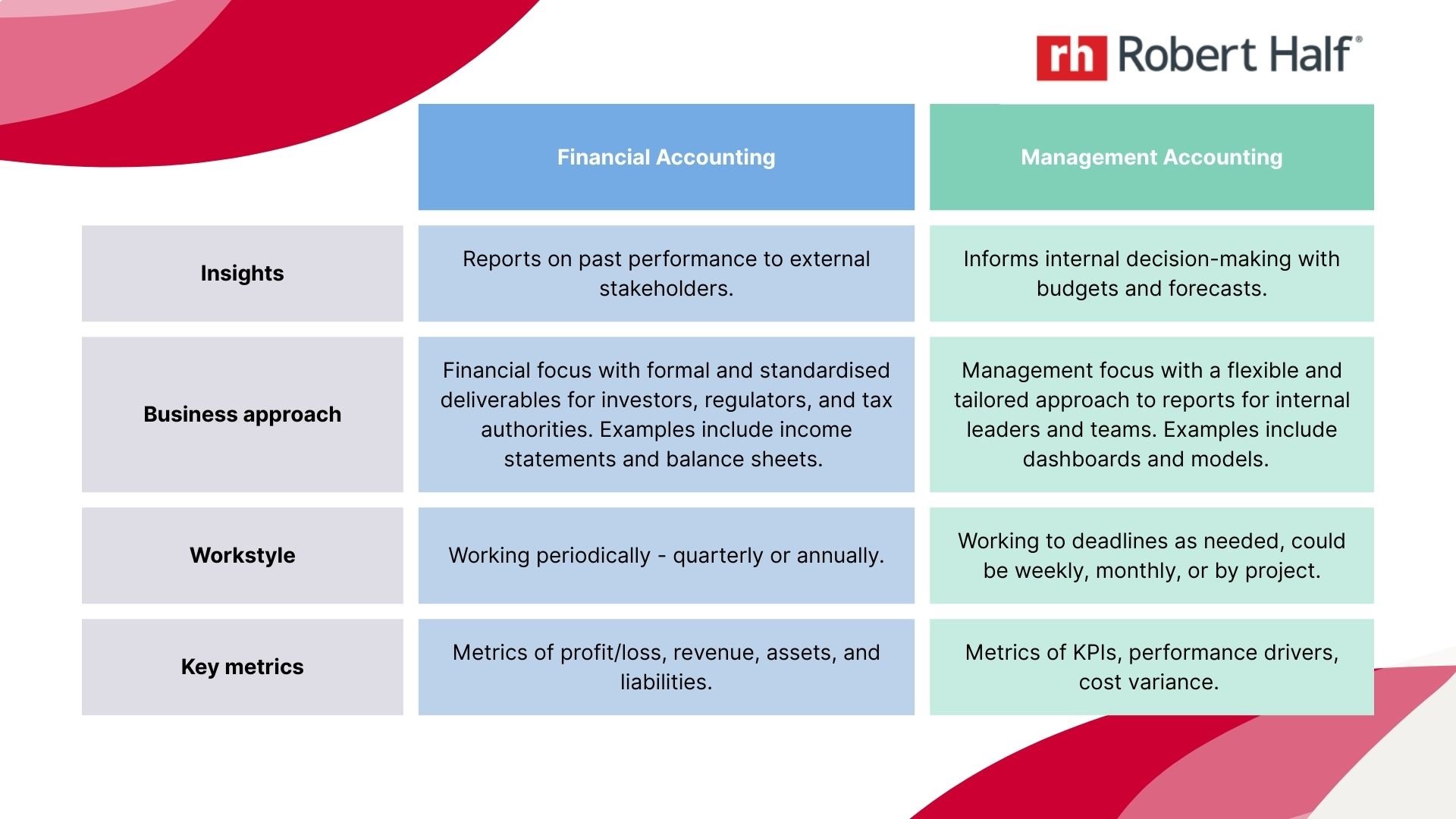

What is management accounting (and how does it differ from financial accounting)

Want to turn numbers into strategy?

Management Accounting might be your next career move.

Never fear if you’re still asking, ‘What is management accounting?’.

It’s a question I get asked frequently (probably because of how often I’m recommending the role).

I liken this position to being the internal compass of a business. It’s about the forward-thinking side of finance. It’s a position that’s focused on helping businesses plan, budget, and make strategic decisions.

As I explain to professionals, Management Accountants analyse key financial information to provide feedback that will aid managerial planning and commercial decisions. The talent that I’ve placed in these roles are pivotal in ensuring the future growth and profitability of their organisations.

Part of their role is to try to reduce the operational and production costs of a company by identifying and implementing more efficient strategies.

I’ve seen firsthand how management accounting can provide a strong foundation for many career paths in finance and accounting.

I’ve also spoken to many people who are unsure about what distinguishes management accounting from traditional financial accounting. I don’t blame them – after all, it’s a role that blends technical accounting with commercial insight.

Let’s explore some of the key differences below.

As I’ve observed, management accounting is a truly versatile skillset.

I’ve placed many candidates in budgeting and forecasting roles and watched them grow into performance analysis, finance business partnering, and even leadership positions.

So, if you’ve big financial and accounting aspirations, know that management accounting could help you reach them.

Related: What accounting careers have to offer

6 things you need to know about management accounting

Think management accounting might be for you?

If you’re considering this field, here are six key things you need to know first.

1. It is internally NOT externally focused

Think strategy over compliance.

Unlike financial accounting, which is geared towards external compliance and reporting, management accounting is about looking inward to optimise performance and efficiency.

As I always tell candidates, management accounting centres around helping companies make smarter and well-informed internal decisions.

2. It is future-focused

When people ask me, “What is management accounting all about?”, I always answer with, “The future”.

Where financial accounting focuses on historical data, management accounting delves into what’s ahead.

It’s a forward-thinking function that involves forecasting, budgeting, and performance analysis to help businesses anticipate trends and prepare for what’s to come.

3. It aids decision-making

I always emphasise to professionals that this isn’t just a number-crunching role.

The most effective management accountants I know collaborate with department heads to interpret numbers and influence business decisions.

Their insights help to guide the business direction, determining everything from resource allocation to long-term investment strategies.

4. It builds upon existing skills

Worried you might not have all the skills?

Don’t be.

If you’ve worked with budgets, tracked spending, helped explain/analyse financial trends or conducted any variance analysis, you’ve already got a foundation in management accounting.

I’ve seen firsthand how a management accounting role is an organic progression for professionals who want to harness these skills in a more strategic context.

5. It’s in demand

My team is always on the lookout for management accounting talent.

Budgeting, cost control, and performance metrics are constantly in demand and are qualities employers often look for in job postings.

Whether you’re a job seeker or a career changer, know that these skills are highly sought after.

If you have them, you could be on your way to the top of a candidate shortlist.

Related: How to negotiate an accounting salary

6. It gives you an upskill advantage

Management accounting may not be your end goal, but wherever you want to go, trust that it will enhance your professional offering.

I believe that fluency in management accounting prepares you for career growth.

I’ve seen just how frequently it’s been a significant career accelerator for my clients.

Whether you’re looking to step into a leadership role or diversify your finance expertise, this unique skillset can position you for long-term success.

What is management accounting to a recruiter?

Find your next management accounting role

As a finance recruiter, I’m acutely aware of the value that Management Accounts bring to their organisations.

For employers, the talent we place in these roles will help them to plan for a stronger, more strategic future.

When it comes to candidates, my team and I know that these roles call for unique individuals, people who can tell the stories behind the numbers, both critically and commercially.

Management Accountants are more than “numbers people”. As recruiters, we know that these professionals can dictate the trajectory of a business.

That’s why my team and I always strive to deliver candidates with:

A strategic mindset – The capacity to interpret the numbers rather than simply report on them.

Business fluency – The ability to translate data into meaningful insights for leaders and stakeholders.

Effective communication skills – The means of collaboration and bridging the gap between finance and wider operations.

Versatility – The ability to shift gears from budgeting, forecasting, and reporting.

Adaptability – A proven track record of resilience in rapidly changing business environments.

As I always explain to clients and candidates, management accounting is what I like to call a ‘launchpad role’, offering high potential for career development.

From my perspective, the role is well-suited to someone eager to learn and grow.

Rest assured, the skills you build in this position can propel you forward in the finance and accounting arena.

I’ve seen how skills like strategic thinking, commercial awareness, and stakeholder management can pave the way toward finance business partnering, senior leadership, or even CFO roles.

Related: Management Accountant

With the future of finance and accounting looking bright, a management accounting role could be worth considering. While it’s not a traditional accounting role, it’s your chance to go beyond the numbers and shape the future of a business (not to mention your finance career).

Want to find your next management accountant role? Talk to the expert team at Robert Half today.

Frequently Asked Questions (FAQs)

What do management accountants do?

A Management Accountant analyses key financial information to provide feedback that will aid managerial planning and commercial decision making, that will ensure the future growth and profitability of your company. Part of the Management Accountant’s role is to try to reduce the operational and production costs of a company by identifying and implementing more efficient strategies.

What skills do you need for management accounting in Australia?

A strategic mindset

Business fluency

Effective communication skills

Versatility

Adaptability

How does management accounting differ from financial accounting in Australia?

Put simply, management accounting looks forward and focuses on helping leaders make better decisions. Financial accounting, on the other hand, reports on past performance.

Management accounting tends to have more of a management focus, particularly in regards to shaping strategy.

Financial accounting has more of a financial focus, particularly on compliance and reports for external stakeholders.

What are the key benefits of management accounting for Australian businesses?

Improved decision-making

Better financial control

Enhanced adaptability

Stronger business performance

Long-term sustainability

What career paths are available in management accounting in Australia?

Management accounting skills are highly transferable across a range of finance careers.

Integral skills like strategic thinking, commercial awareness, and stakeholder management can pave the way toward finance business partnering, performance analysis, senior leadership, or even CFO roles.