LEASE ACCOUNTING STANDARD ADOPTION AT PRIVATE COMPANIES, BY INDUSTRY

Has your company begun the transition to the new lease accounting standard?

| Yes, completed | Yes, started but not completed | No | |||

|---|---|---|---|---|---|

| NATIONAL | 56% | 26% | 18% | ||

| BUSINESS SERVICES | 59% | 28% | 13% | ||

| CONSTRUCTION | 57% | 25% | 18% | ||

| FINANCE | 53% | 30% | 18% | ||

| MANUFACTURING | 51% | 23% | 26% | ||

| PROFESSIONAL SERVICES | 54% | 27% | 19% | ||

| RETAIL/WHOLESALE | 48% | 34% | 18% | ||

| TRANSPORTATION/PUBLIC UTILITIES | 69% | 25% | 6% | ||

| OTHER | 63% | 23% | 14% |

CFOs who reported their company hasn’t completed the transition also were asked the question below:

How concerned are you about meeting the deadline?

| Very concerned | Somewhat concerned | Not at all concerned | ||

|---|---|---|---|---|

| NATIONAL | 18% | 44% | 39% | |

| BUSINESS SERVICES | 15% | 69% | 15% | |

| CONSTRUCTION | 31% | 24% | 45% | |

| FINANCE | 35% | 31% | 35% | |

| MANUFACTURING | 15% | 44% | 41% | |

| PROFESSIONAL SERVICES | 5% | 59% | 37% | |

| RETAIL/WHOLESALE | 9% | 53% | 38% | |

| TRANSPORTATION/PUBLIC UTILITIES | 20% | 40% | 40% | |

| OTHER | 19% | 38% | 44% |

What is the most challenging aspect of the transition to the new standard?

(Answer options included: diagnosing the needed changes; finding professionals with the requisite expertise; identifying, inventorying and categorizing company’s leases; managing change; training staff; updating technology)

| NATIONAL | Training staff | |

| BUSINESS SERVICES | Identifying, inventorying and categorizing company’s leases | |

| CONSTRUCTION | Training staff | |

| FINANCE | Identifying, inventorying and categorizing company’s leases | |

| MANUFACTURING | Managing change | |

| PROFESSIONAL SERVICES | Training staff | |

| RETAIL/WHOLESALE | Training staff | |

| TRANSPORTATION/PUBLIC UTILITIES | Identifying, inventorying and categorizing company’s leases | |

| OTHER | Managing change |

CFOs who reported their company has completed the transition also were asked the questions below:

Which of the tools did you use for first-year compliance with the new lease accounting standard?

| NATIONAL |

| Cutting-edge, advanced technologies 59% |

| Spreadsheets 52% |

| Lease accounting software 49% |

| Paper-based records 39% |

| BUSINESS SERVICES |

| Cutting-edge, advanced technologies 47% |

| Spreadsheets 47% |

| Lease accounting software 42% |

| Paper-based records 32% |

| CONSTRUCTION |

| Cutting-edge, advanced technologies 67% |

| Spreadsheets 44% |

| Lease accounting software 59% |

| Paper-based records 49% |

| FINANCE |

| Cutting-edge, advanced technologies 66% |

| Spreadsheets 47% |

| Lease accounting software 31% |

| Paper-based records 41% |

| MANUFACTURING |

| Cutting-edge, advanced technologies 69% |

| Spreadsheets 69% |

| Lease accounting software 47% |

| Paper-based records 36% |

| PROFESSIONAL SERVICES |

| Cutting-edge, advanced technologies 48% |

| Spreadsheets 52% |

| Lease accounting software 50% |

| Paper-based records 38% |

| RETAIL/WHOLESALE |

| Cutting-edge, advanced technologies 47% |

| Spreadsheets 50% |

| Lease accounting software 40% |

| Paper-based records 50% |

| TRANSPORTATION/PUBLIC UTILITIES |

| Cutting-edge, advanced technologies 73% |

| Spreadsheets 82% |

| Lease accounting software 27% |

| Paper-based records 55% |

| OTHER |

| Cutting-edge, advanced technologies 58% |

| Spreadsheets 47% |

| Lease accounting software 58% |

| Paper-based records 31% |

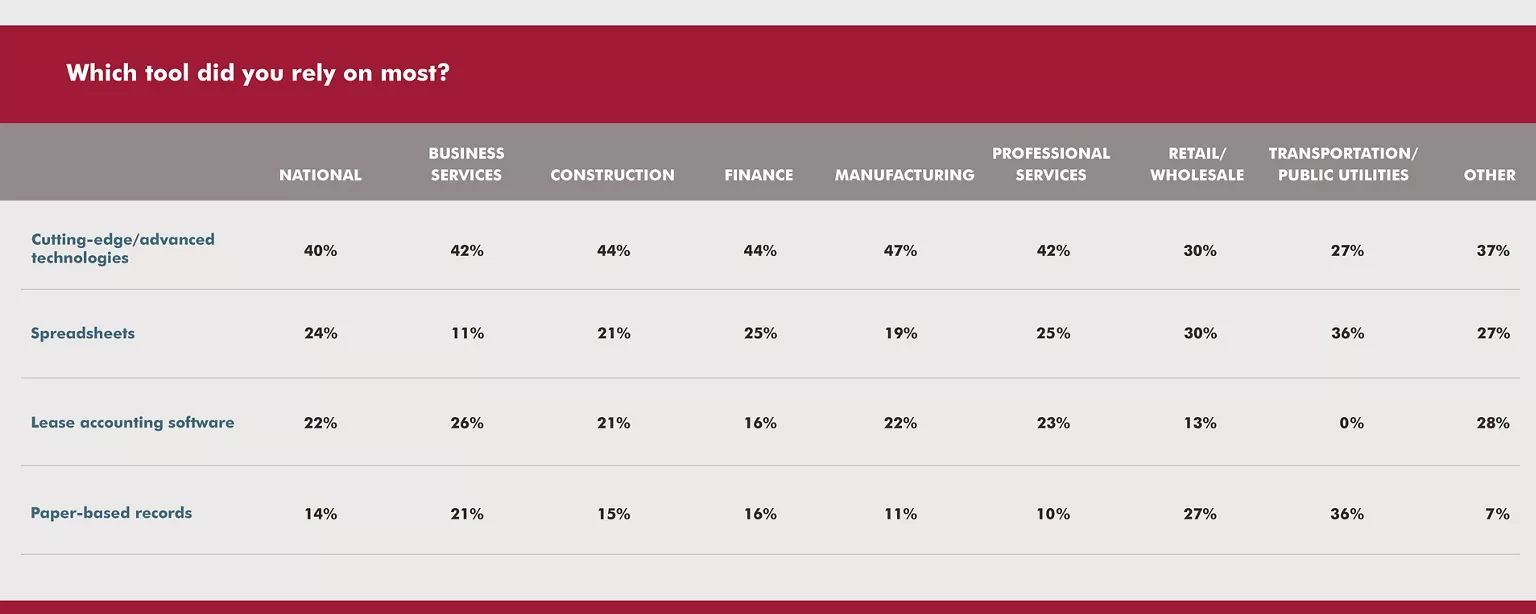

Which tool did you rely on most?

| NATIONAL |

| Cutting-edge, advanced technologies 40% |

| Spreadsheets 24% |

| Lease accounting software 22% |

| Paper-based records 14% |

| BUSINESS SERVICES |

| Cutting-edge, advanced technologies 42% |

| Spreadsheets 11% |

| Lease accounting software 26% |

| Paper-based records 21% |

| CONSTRUCTION |

| Cutting-edge, advanced technologies 44% |

| Spreadsheets 21% |

| Lease accounting software 21% |

| Paper-based records 15% |

| FINANCE |

| Cutting-edge, advanced technologies 44% |

| Spreadsheets 25% |

| Lease accounting software 16% |

| Paper-based records 16% |

| MANUFACTURING |

| Cutting-edge, advanced technologies 47% |

| Spreadsheets 19% |

| Lease accounting software 22% |

| Paper-based records 11% |

| PROFESSIONAL SERVICES |

| Cutting-edge, advanced technologies 42% |

| Spreadsheets 25% |

| Lease accounting software 23% |

| Paper-based records 10% |

| RETAIL/WHOLESALE |

| Cutting-edge, advanced technologies 30% |

| Spreadsheets 30% |

| Lease accounting software 13% |

| Paper-based records 27% |

| TRANSPORTATION/PUBLIC UTILITIES |

| Cutting-edge, advanced technologies 27% |

| Spreadsheets 36% |

| Lease accounting software 0% |

| Paper-based records 36% |

| OTHER |

| Cutting-edge, advanced technologies 37% |

| Spreadsheets 27% |

| Lease accounting software 28% |

| Paper-based records 7% |

If you plan to change your approach to compliance in future years, which tool do you anticipate relying on most?

| NATIONAL |

| Cutting-edge, advanced technologies 41% |

| Lease accounting software 25% |

| Spreadsheets 18% |

| Paper-based records 11% |

| Not planning to change 5% |

| BUSINESS SERVICES |

| Cutting-edge, advanced technologies 47% |

| Lease accounting software 16% |

| Spreadsheets 5% |

| Paper-based records 21% |

| Not planning to change 11% |

| CONSTRUCTION |

| Cutting-edge, advanced technologies 44% |

| Lease accounting software 23% |

| Spreadsheets 18% |

| Paper-based records 15% |

| Not planning to change 0% |

| FINANCE |

| Cutting-edge, advanced technologies 47% |

| Lease accounting software 19% |

| Spreadsheets 16% |

| Paper-based records 3% |

| Not planning to change 16% |

| MANUFACTURING |

| Cutting-edge, advanced technologies 42% |

| Lease accounting software 17% |

| Spreadsheets 11% |

| Paper-based records 17% |

| Not planning to change 14% |

| PROFESSIONAL SERVICES |

| Cutting-edge, advanced technologies 48% |

| Lease accounting software 19% |

| Spreadsheets 25% |

| Paper-based records 4% |

| Not planning to change 4% |

| RETAIL/WHOLESALE |

| Cutting-edge, advanced technologies 33% |

| Lease accounting software 27% |

| Spreadsheets 23% |

| Paper-based records 17% |

| Not planning to change 0% |

| TRANSPORTATION/PUBLIC UTILITIES |

| Cutting-edge, advanced technologies 46% |

| Lease accounting software 36% |

| Spreadsheets 9% |

| Paper-based records 9% |

| Not planning to change 0% |

| OTHER |

| Cutting-edge, advanced technologies 32% |

| Lease accounting software 35% |

| Spreadsheets 21% |

| Paper-based records 10% |

| Not planning to change 3% |

CFOS who reported their company has started or completed the transition also were asked the question below:

How do you anticipate staffing future lease accounting compliance initiatives?

| NATIONAL |

| Combination of internal and external resources 47% |

| Internal resources only 39% |

| External resources only 14% |

| BUSINESS SERVICES |

| Combination of internal and external resources 54% |

| Internal resources only 39% |

| External resources only 7% |

| CONSTRUCTION |

| Combination of internal and external resources 52% |

| Internal resources only 38% |

| External resources only 11% |

| FINANCE |

| Combination of internal and external resources 50% |

| Internal resources only 38% |

| External resources only 12% |

| MANUFACTURING |

| Combination of internal and external resources 56% |

| Internal resources only 29% |

| External resources only 15% |

| PROFESSIONAL SERVICES |

| Combination of internal and external resources 42% |

| Internal resources only 42% |

| External resources only 17% |

| RETAIL/WHOLESALE |

| Combination of internal and external resources 41% |

| Internal resources only 39% |

| External resources only 20% |

| TRANSPORTATION/PUBLIC UTILITIES |

| Combination of internal and external resources 47% |

| Internal resources only 40% |

| External resources only 13% |

| OTHER |

| Combination of internal and external resources 42% |

| Internal resources only 43% |

| External resources only 14% |

Source: Robert Half and Protiviti survey of more than 500 private company CFOs in the United States; totals may not equal 100 percent due to rounding

*Multiple responses were allowed.

© 2019 Robert Half International Inc. An Equal Opportunity Employer M/F/Disability/Veterans.